All Categories

Featured

If you're healthy and balanced and have never used cigarette, you'll usually pay even more for home loan security insurance coverage than you would certainly for term life insurance policy (protection plan loan). Unlike various other sorts of insurance policy, it's challenging to get a quote for home mortgage protection insurance online - mortgage insurance coverage. Rates for mortgage defense insurance coverage can vary extensively; there is much less openness in this market and there are a lot of variables to properly compare prices

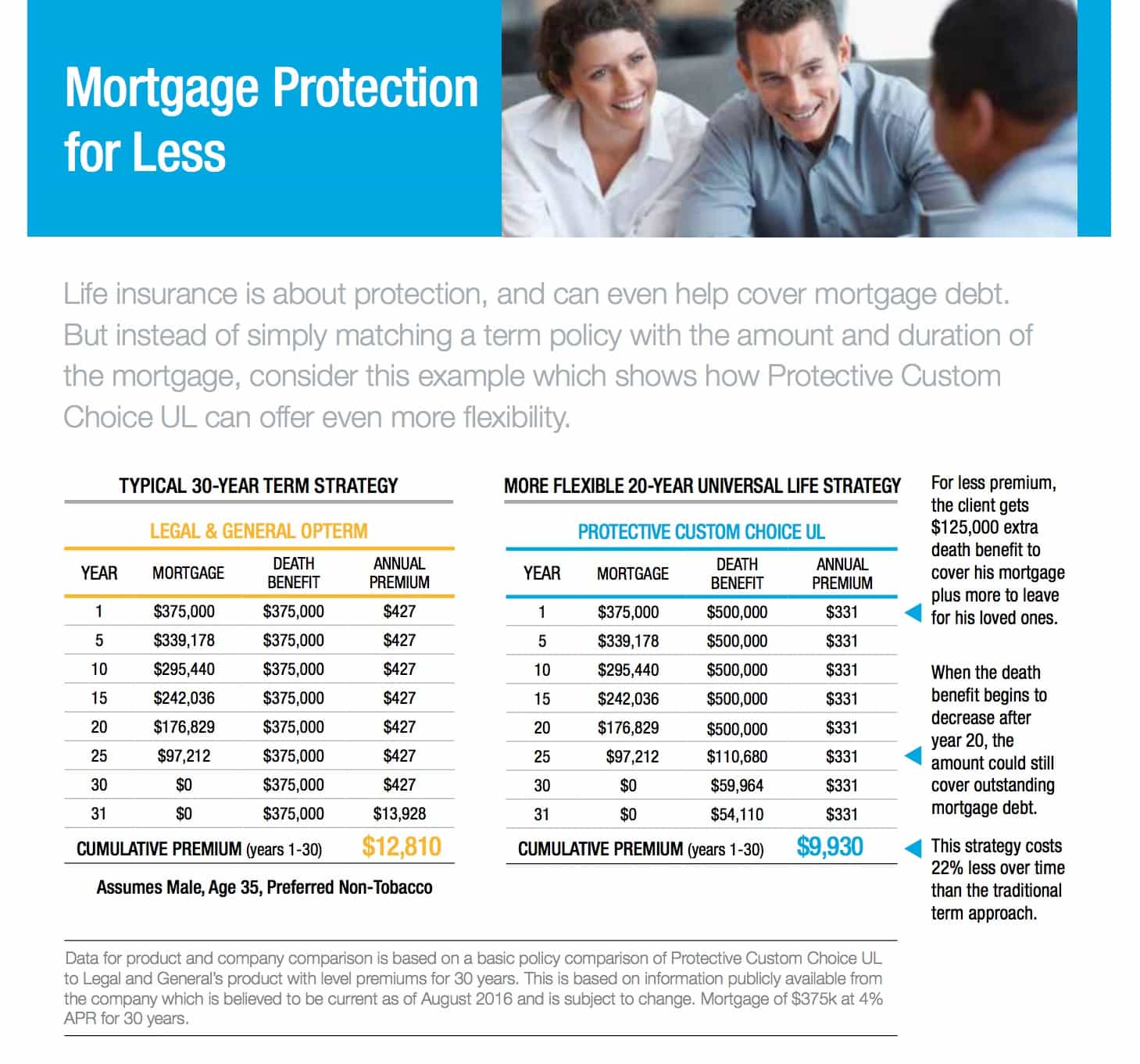

Term life is a superb option for mortgage protection. Policyholders can take advantage of several benefits: The amount of coverage isn't limited to your home mortgage equilibrium. The death payment continues to be the very same for the term of the policy. The beneficiaries can utilize the plan continues for any kind of objective. The policy supplies a survivor benefit even after the home loan is repaid.

You might desire your life insurance coverage plan to safeguard even more than just your mortgage. You select the policy value, so your protection can be extra or less than your home mortgage balance - why do i need mortgage insurance.

If you're guaranteed and pass away while your term life plan is still active, your picked liked one(s) can utilize the funds to pay the mortgage or for an additional function they pick. mortgage payment protection insurance. There are several benefits to using term life insurance policy to secure your mortgage. Still, it might not be an ideal remedy for everyone

Mortgage Related Life Insurance

Yes, since life insurance plans have a tendency to align with the specifics of a home loan. If you acquire a 250,000 house with a 25-year home mortgage, it makes feeling to acquire life insurance policy that covers you for this much, for this lengthy.

Your family members or beneficiaries receive their round figure and they can invest it as they like (mortgage insurance if you lose your job). It is necessary to understand, nonetheless, that the Home loan Security payout sum decreases in accordance with your mortgage term and balance, whereas level term life insurance policy will pay the same round figure any time throughout the policy length

Cheap Insurance Mortgage Protection

You could see that as you not obtaining your payment. On the various other hand, you'll be active so It's not like paying for Netflix. You do not see an obvious or upfront return of what you purchase. The sum you invest on life insurance policy each month doesn't repay until you're no more right here.

After you're gone, your enjoyed ones do not need to fret regarding missing payments or being unable to manage living in their home (loan protection insurance comparison). There are 2 primary ranges of home loan security insurance policy, degree term and reducing term. It's constantly best to obtain recommendations to figure out the plan that finest talks to your needs, spending plan and situations

Latest Posts

What Is The Best Final Expense Company To Work For

Aig Burial Insurance

Best Burial Insurance