All Categories

Featured

Table of Contents

- – What is Level Premium Term Life Insurance Poli...

- – Why You Should Consider What Does Level Term L...

- – What is What Is Direct Term Life Insurance? P...

- – What is Life Insurance Level Term? Explained ...

- – What is the Role of Term Life Insurance For ...

- – How Do You Define Annual Renewable Term Life...

If George is identified with a terminal illness during the first policy term, he probably will not be qualified to restore the policy when it expires. Some plans supply guaranteed re-insurability (without evidence of insurability), but such features come at a higher price. There are several sorts of term life insurance policy.

Most term life insurance coverage has a degree premium, and it's the kind we've been referring to in most of this short article.

Term life insurance is attractive to young individuals with kids. Moms and dads can obtain substantial insurance coverage for a reduced price, and if the insured dies while the plan is in impact, the family can rely on the survivor benefit to replace lost earnings. These plans are likewise appropriate for people with growing households.

What is Level Premium Term Life Insurance Policies Coverage Like?

The appropriate selection for you will depend upon your demands. Here are some things to take into consideration. Term life plans are perfect for people who desire considerable coverage at an affordable. Individuals who have whole life insurance policy pay extra in costs for less insurance coverage but have the protection of recognizing they are protected for life.

The conversion biker need to enable you to convert to any type of long-term plan the insurance provider provides without limitations. The key features of the motorcyclist are preserving the original health rating of the term policy upon conversion (even if you later have wellness issues or come to be uninsurable) and making a decision when and exactly how much of the protection to convert.

Of training course, total premiums will certainly boost considerably because whole life insurance policy is more costly than term life insurance. Medical conditions that establish during the term life duration can not cause premiums to be boosted.

Why You Should Consider What Does Level Term Life Insurance Mean

Whole life insurance comes with substantially greater monthly premiums. It is meant to supply coverage for as long as you live.

It depends upon their age. Insurer established a maximum age limitation for term life insurance policy plans. This is normally 80 to 90 years of ages yet may be greater or reduced depending on the firm. The premium likewise increases with age, so a person matured 60 or 70 will pay substantially greater than a person years younger.

Term life is rather similar to auto insurance coverage. It's statistically unlikely that you'll require it, and the costs are cash down the tubes if you do not. If the worst takes place, your family members will obtain the advantages.

What is What Is Direct Term Life Insurance? Pros, Cons, and Considerations?

For the a lot of component, there are two sorts of life insurance coverage plans - either term or long-term plans or some combination of both. Life insurance companies use different forms of term strategies and conventional life plans as well as "rate of interest sensitive" products which have come to be a lot more prevalent because the 1980's.

Term insurance coverage offers security for a specified time period. This period could be as short as one year or supply insurance coverage for a particular variety of years such as 5, 10, 20 years or to a defined age such as 80 or in some cases approximately the earliest age in the life insurance mortality.

What is Life Insurance Level Term? Explained in Detail

Presently term insurance coverage prices are very competitive and among the most affordable traditionally experienced. It should be noted that it is a commonly held belief that term insurance is the least pricey pure life insurance protection readily available. One needs to evaluate the policy terms very carefully to determine which term life choices are appropriate to satisfy your particular conditions.

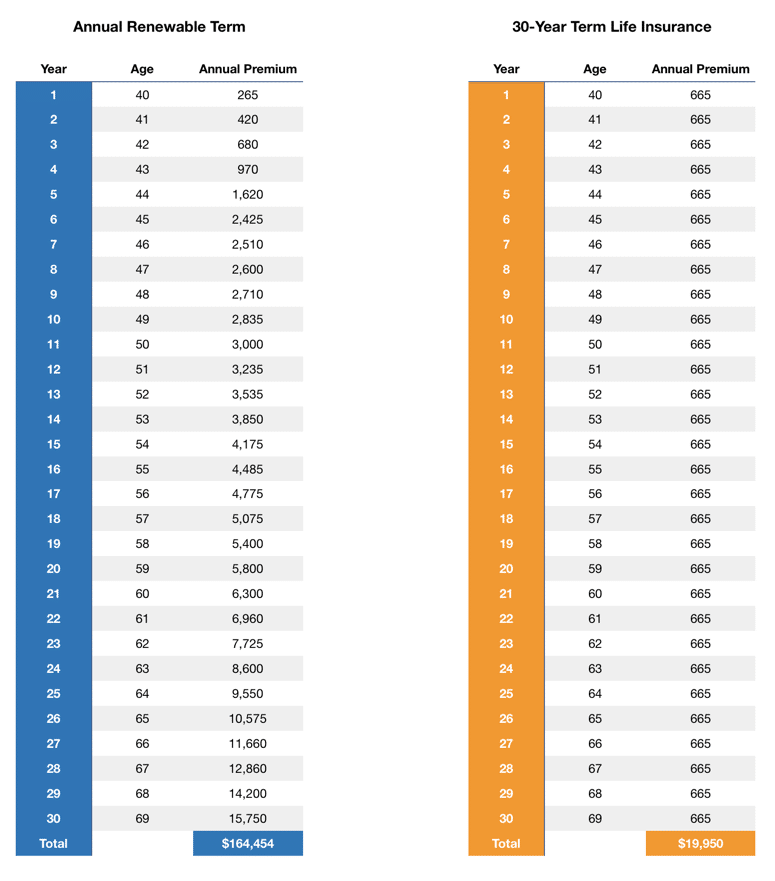

With each new term the premium is raised. The right to restore the plan without proof of insurability is an essential benefit to you. Or else, the danger you take is that your wellness may wear away and you might be incapable to acquire a plan at the exact same prices or also at all, leaving you and your beneficiaries without coverage.

The length of the conversion period will certainly vary depending on the kind of term policy purchased. The costs price you pay on conversion is usually based on your "existing obtained age", which is your age on the conversion date.

Under a level term plan the face quantity of the policy remains the exact same for the whole duration. With reducing term the face quantity decreases over the period. The premium stays the exact same yearly. Commonly such plans are sold as home mortgage security with the quantity of insurance reducing as the equilibrium of the home loan reduces.

Traditionally, insurance companies have actually not deserved to change premiums after the plan is sold. Considering that such plans may proceed for several years, insurance companies need to use traditional death, rate of interest and expense price estimates in the premium computation. Flexible costs insurance coverage, nonetheless, permits insurance firms to supply insurance coverage at lower "existing" premiums based upon less conservative assumptions with the right to change these costs in the future.

What is the Role of Term Life Insurance For Couples?

While term insurance policy is created to give security for a defined period, permanent insurance is created to give protection for your entire lifetime. To maintain the costs rate level, the premium at the younger ages exceeds the actual expense of security. This extra premium develops a get (money worth) which assists spend for the plan in later years as the expense of protection rises above the premium.

The insurance policy firm invests the excess premium bucks This kind of policy, which is often called cash worth life insurance coverage, produces a cost savings aspect. Cash worths are essential to a long-term life insurance policy.

In some cases, there is no connection in between the size of the cash money worth and the costs paid. It is the cash money value of the plan that can be accessed while the insurance holder lives. The Commissioners 1980 Requirement Ordinary Death Table (CSO) is the present table made use of in determining minimal nonforfeiture worths and policy reserves for normal life insurance policies.

How Do You Define Annual Renewable Term Life Insurance?

Several irreversible plans will consist of provisions, which define these tax obligation demands. Typical whole life policies are based upon long-lasting estimates of expense, passion and mortality.

Table of Contents

- – What is Level Premium Term Life Insurance Poli...

- – Why You Should Consider What Does Level Term L...

- – What is What Is Direct Term Life Insurance? P...

- – What is Life Insurance Level Term? Explained ...

- – What is the Role of Term Life Insurance For ...

- – How Do You Define Annual Renewable Term Life...

Latest Posts

What Is The Best Final Expense Company To Work For

Aig Burial Insurance

Best Burial Insurance

More

Latest Posts

What Is The Best Final Expense Company To Work For

Aig Burial Insurance

Best Burial Insurance